Executive Summary

As foundational AI models become increasingly commoditized and computing costs plummet, we’re witnessing a seismic shift in the technology landscape. AI giants like OpenAI, Anthropic, Google, and Mistral are no longer content with simply providing foundational models—they’re aggressively expanding into enterprise services, consulting, and implementation services that have traditionally been the domain of IT services companies. This transformation represents both an existential threat and an unprecedented opportunity for traditional IT services providers, from global giants like Accenture and Infosys to specialized engineering firms like Globant and EPAM.

The Next Frontier: Beyond Model Commoditization

The Strategic Pivot

OpenAI has rapidly expanded beyond its foundational models, making seven acquisitions across sectors including enterprise collaboration and AI infrastructure, with recent high-profile deals including the $6.5B acquisition of iO and the $1.1B acquisition of Statsig. This aggressive expansion signals a clear strategic shift: as models become commoditized, the real value lies in enterprise integration, workflow automation, and industry-specific solutions.

Anthropic, valued at $61.5 billion following its latest $3.5 billion Series E funding round, has positioned itself as a leader in enterprise AI adoption, with Claude being used by organizations ranging from fast-growing startups to global corporations like Zoom, Snowflake, and Pfizer.

The foundational model leaders recognize three critical realities:

- Model Performance Convergence: As AI capabilities plateau at human-level performance for many tasks, differentiation increasingly depends on integration and implementation excellence

- Enterprise Adoption Complexity: Fortune 500 companies require comprehensive solutions, not just APIs

- Revenue Scale Requirements: With OpenAI burning approximately $8 billion annually while generating $12 billion in revenue, sustainable profitability demands expansion beyond pure model licensing

Strategic Expansions: The New Battlefield

OpenAI’s Enterprise Offensive

OpenAI now serves 3 million paying business users across ChatGPT Enterprise, Team, and Edu offerings, with the company signing nine new enterprises weekly. The company has built a go-to-market team of over 700 people, growing from just 50 in 18 months.

Key enterprise expansions include:

- Workflow Integration: “Connectors” allowing workers to pull data from Google Drive, Dropbox, SharePoint, and OneDrive

- Meeting Intelligence: “Record mode” for meeting transcription and follow-up

- Industry Solutions: Custom implementations for companies like Morgan Stanley, Moderna, and Uber

Anthropic’s Claude Enterprise Strategy

Anthropic’s Claude Enterprise plan offers expanded 500K context windows, native GitHub integration, and enterprise-grade security features including SSO and role-based permissions. The company now bundles Claude Code with enterprise plans, providing comprehensive development lifecycle support.

Strategic partnerships include:

- Five-year partnership with Databricks to offer Claude models natively through the Data Intelligence Platform for over 10,000 companies

- $200 million Department of Defense contract for AI in military applications

- Government access program offering Claude for Enterprise and Claude for Government to all three branches of government for $1

Google and Mistral’s Market Penetration

Google’s expanded partnership with Salesforce brings Gemini models to Agentforce, enabling businesses to build AI agents with multi-modal capabilities and 2 million-token context windows.

Mistral AI has made enterprise features free, introducing Model Context Protocol (MCP) connectors for direct integration with enterprise platforms including Databricks, Snowflake, GitHub, and financial services platforms like Stripe and PayPal.

Are They Encroaching on Traditional IT Services?

Expansion Analysis Matrix

| Company | Traditional IT Services Encroachment | Evidence |

|---|---|---|

| OpenAI | High | – 700+ person go-to-market team – Enterprise consulting services – Custom implementation projects – Direct enterprise sales model |

| Anthropic | Medium-High | – Enterprise solution design – Government consulting contracts – Industry-specific implementations – Partnership-driven delivery model |

| Google (Gemini) | Medium | – Leveraging existing Google Cloud services – Partner ecosystem approach – Integration consulting through partners |

| Mistral | Low-Medium | – Free enterprise tools strategy – Platform-based approach – Partner-dependent implementation |

Why This Expansion is Inevitable and the new AI dominant stack

Economic Pressure: OpenAI is on track to burn $8 billion this year while both OpenAI and Anthropic spend heavily to lock in customers. Pure model licensing doesn’t provide sufficient margins for sustainable growth.

Market Demand: Almost all companies are investing in AI, but just 1% believe they are at maturity. This gap creates massive demand for implementation services.

Customer Stickiness: Direct enterprise relationships provide higher switching costs and recurring revenue compared to API-only models.

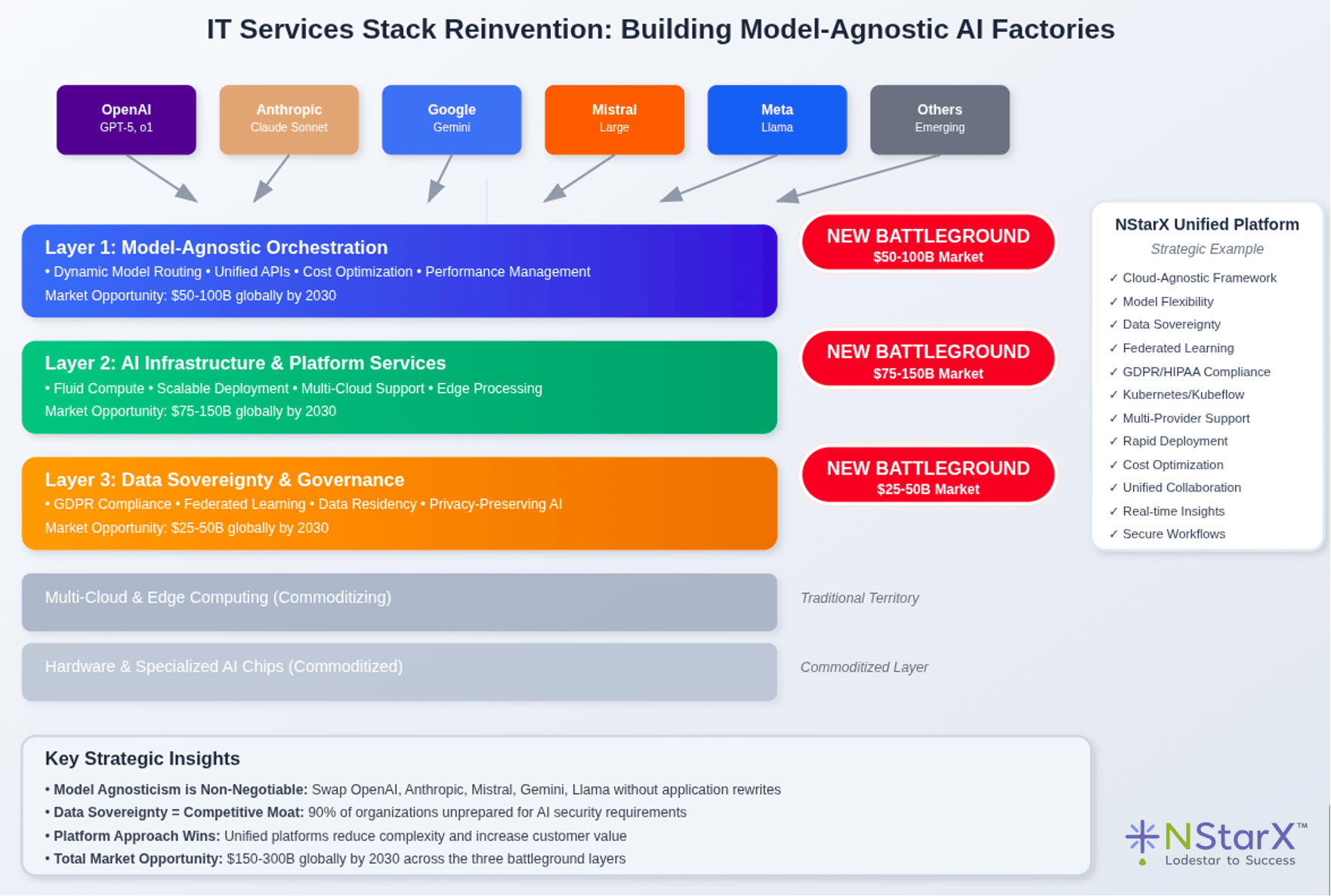

As the Industry, we will be see the evolution of new AI dominant stack. The same representation as show in the Figure 1:

Figure 1: IT Services Reimagined through modern Data and AI stack

Impact on Traditional IT Services Companies

Global Leaders’ Strategic Response

Accenture, maintaining its position as the world’s most valuable IT services brand, has expanded its cybersecurity professionals by 30% to over 25,000 people and secured $3 billion in new generative AI bookings in 2024.

Capgemini’s $3.3 billion acquisition of WNS creates a global leader in Agentic AI-powered Intelligent Operations, leveraging strategic partnerships with Microsoft, Google, AWS, Mistral AI, and NVIDIA.

Threat Assessment by Company Category

| Company Type | Threat Level | Primary Concerns | Strategic Response |

|---|---|---|---|

| Global Consultancies (Accenture, Deloitte, Capgemini) | Medium | – Direct competition for enterprise AI projects – Margin pressure on implementation services |

– Massive AI acquisitions and partnerships – 25+ strategic AI partnerships – Specialized AI service offerings |

| Indian IT Giants (TCS, Infosys, Wipro) | High | – Automation of traditional offshore services – Competition for enterprise modernization projects |

– Heavy investment in AI capabilities – Focus on industry-specific AI solutions – Talent reskilling programs |

| Specialized Engineering (Globant, EPAM) | Medium-High | – AI-native competitors – Commoditization of development services |

– AI-first service models – Subscription-based AI services – Deep AI integration capabilities |

Opportunities vs. Threats Analysis

| Traditional IT Services Segment | Threat Level | Opportunity Level | Net Impact |

|---|---|---|---|

| Routine Development | Very High | Low | Negative |

| Legacy System Modernization | Medium | Very High | Positive |

| AI Implementation Consulting | Low | Very High | Very Positive |

| Industry-Specific Solutions | Medium | High | Positive |

| Change Management | Low | High | Positive |

| Cybersecurity & Governance | Low | Very High | Very Positive |

Strategic Opportunities for IT Services Industry

The New Value Stack

Globant has introduced AI Pods, the first subscription model for AI-powered services, offering agentic AI orchestrated by experts to ensure strategic alignment, quality, and traceability.

EPAM has expanded its strategic collaboration with AWS, focusing on developing GenAI solutions with 15,000+ AWS-experienced engineers across 55+ countries.

Opportunity Matrix for IT Services Companies

| Opportunity Area | Revenue Potential | Competitive Advantage | Implementation Timeline |

|---|---|---|---|

| AI Integration & Orchestration | $50-100B globally | Deep industry knowledge + AI expertise | 12-18 months |

| Model-Agnostic Platforms | $20-40B globally | Vendor independence + flexibility | 18-24 months |

| AI Governance & Compliance | $15-25B globally | Regulatory expertise + risk management | 6-12 months |

| Legacy AI Modernization | $75-150B globally | Existing client relationships + migration expertise | 24-36 months |

| Industry-Specific AI Solutions | $100-200B globally | Domain expertise + customization capabilities | 18-30 months |

Success Factors for Traditional IT Services

- Speed to Market: AI technology is advancing at record speed, with ChatGPT reaching 300 million weekly users in just two years.

- Hybrid Expertise: Combining AI capabilities with deep industry knowledge and change management expertise

- Platform Strategy: Building model-agnostic solutions that prevent vendor lock-in

- Talent Investment: Companies plan to increase AI investment by 14% year-over-year in 2025

Reimagining Traditional IT Services Companies

Transformation Imperatives

For Large Global Firms:

- Acquire AI-Native Capabilities: Follow Capgemini’s WNS acquisition model

- Build AI Centers of Excellence: Invest heavily in AI talent and partnerships

- Develop Industry AI Accelerators: Create pre-built AI solutions for specific verticals

- Establish Model Partnerships: Secure preferred partnerships with multiple AI providers

For Mid-Tier Companies:

- Specialize in AI Implementation: Become the go-to experts for specific AI use cases

- Focus on Compliance and Governance: Address the 90% of organizations unprepared for AI security

- Build Integration Platforms: Create tools that connect multiple AI services

- Develop Change Management Expertise: Help organizations navigate AI adoption

Essential Strategic Moves

| Timeline | Large Firms (>$10B) | Mid-Tier ($1-10B) | Specialized (<$1B)< /b> |

|---|---|---|---|

| 0-6 months | – Acquire AI companies – Launch AI CoEs – Reskill 50% of workforce |

– Partner with AI providers – Develop AI expertise – Create specialized offerings |

– Focus on niche AI applications – Build deep AI skills – Partner with larger firms |

| 6-18 months | – Launch AI platforms – Expand globally – Build proprietary IP |

– Scale AI delivery – Develop case studies – Expand service offerings |

– Establish market presence – Build repeatable solutions – Form strategic alliances |

| 18+ months | – Market leadership – Ecosystem orchestration – Next-gen AI development |

– Regional leadership – Industry specialization – Platform development |

– Deep specialization – Premium positioning – Acquisition target |

Survival Strategies for Small Specialized Firms

The David vs. Goliath Playbook

Globant’s transformation demonstrates how specialized firms can compete by reimagining traditional IT services with AI-first approaches, introducing subscription models and agentic AI workflows.

Core Survival Strategies:

- Hyper-Specialization: Focus on specific industries or use cases where deep expertise creates moats

- AI-Native Business Models: Like Globant’s AI Pods, create subscription-based AI services

- Partnership Ecosystem: Align with multiple AI providers to avoid vendor lock-in

- Talent Differentiation: Invest heavily in AI expertise and industry knowledge

- Speed Advantage: Leverage smaller size for faster decision-making and implementation

Niche Market Opportunities

| Specialization Area | Market Size | Competitive Intensity | Success Probability |

|---|---|---|---|

| Healthcare AI Compliance | $5-8B | Low | High |

| Financial Services AI | $15-25B | High | Medium |

| Manufacturing AI Integration | $10-15B | Medium | High |

| AI for Government | $8-12B | Low | High |

| AI Ethics and Governance | $3-5B | Very Low | Very High |

Board and Executive Reimagination

Strategic Imperatives for Leadership

Board-Level Decisions:

- AI Investment Allocation: Allocate 20-30% of annual revenue to AI transformation

- Acquisition Strategy: Target AI-native companies and specialized talent

- Risk Management: Address the fact that 90% of organizations are not adequately prepared to secure their AI-driven future

- Talent Strategy: Invest in massive reskilling programs

Executive Actions:

- Speed of Decision Making: Compress traditional 12-18 month planning cycles to 3-6 months

- Partnership Portfolio: Establish relationships with 3-5 AI providers to avoid dependence

- Customer Education: Lead clients through AI transformation rather than following demand

- Internal AI Adoption: Use AI extensively internally before selling to clients

Investment Framework

| Investment Area | Percentage of Revenue | Timeline | Expected ROI |

|---|---|---|---|

| AI Talent Acquisition | 8-12% | 12-18 months | 300-500% |

| AI Platform Development | 5-8% | 18-24 months | 200-400% |

| Partnership and Alliances | 2-3% | 6-12 months | 150-250% |

| Training and Reskilling | 3-5% | 6-18 months | 250-350% |

| AI R&D and Innovation | 5-10% | 24-36 months | 400-800% |

The Era of Uncertainty as Opportunity

Why This Disruption Creates Massive Value

- Market Expansion: McKinsey projects AI could deliver additional global economic activity of around $13 trillion by 2030, or about 16% higher cumulative GDP.

- Talent Premium: While 170 million new jobs are projected to be created this decade, 77% of AI jobs require master’s degrees, creating massive talent premiums.

- Customer Dependency: Organizations are increasingly dependent on external expertise to navigate AI transformation, creating opportunities for trusted advisors.

The Opportunity Landscape

For Traditional IT Services:

- AI Implementation Gap: Just 1% of companies believe they are at AI maturity

- Security and Governance Needs: Address the 90% of organizations unprepared for AI security

- Integration Complexity: Help organizations integrate multiple AI providers

- Change Management: Support workforce transitions and cultural transformation

Value Creation Mechanisms:

- Higher Margins: AI services command 30-50% higher margins than traditional IT services

- Recurring Revenue: AI platforms and ongoing optimization create subscription-like revenue

- Customer Stickiness: Deep AI integration creates higher switching costs

- Market Expansion: AI enables entry into new industries and use cases

Future Outlook: The Interesting Times Ahead

The Three-Horizon Transformation

Horizon 1 (2025-2027): Integration and Augmentation

- AI augments rather than replaces most IT services

- Focus on workflow integration and productivity enhancement

- Traditional firms build AI capabilities through partnerships

Horizon 2 (2027-2030): Platform Consolidation

- Market consolidation around major AI platforms

- Emergence of industry-specific AI solutions

- Traditional firms either acquire AI capabilities or become niche specialists

Horizon 3 (2030+): AI-Native Economy

- AI becomes infrastructure rather than application

- Value shifts to human creativity, strategy, and relationship management

- Successful firms have completely reimagined their business models

Why This Uncertainty is Actually Opportunity

- Market Size Explosion: The total addressable market for AI services will likely exceed the entire current IT services market

- Differentiation Reset: Current competitive advantages become less relevant, leveling the playing field

- Customer Transformation: Organizations need comprehensive transformation partners, not just vendors

- Talent Arbitrage: Early investment in AI talent creates sustainable competitive advantages

Conclusion: Navigating the Great Transformation

The convergence of commoditized AI models and aggressive enterprise expansion by foundational model companies represents the most significant disruption to the IT services industry since the internet. However, history shows us that technological disruptions create more value than they destroy—they simply redistribute it.

The winners in this transformation will be organizations that:

- Act with urgency while their competitors analyze

- Invest in AI capabilities rather than defending traditional models

- Partner strategically with AI providers while maintaining independence

- Focus on customer outcomes rather than technological features

- Build hybrid expertise combining AI capabilities with industry knowledge

The future belongs to organizations that can successfully orchestrate AI capabilities, manage complex integrations, and guide customers through transformational change. For IT services companies willing to reimagine their business models, this era of uncertainty represents the greatest opportunity for growth and differentiation in decades.

The question isn’t whether AI will disrupt the IT services industry—it already has. The question is whether your organization will be among the architects of the new landscape or a casualty of the transformation.

Citations

- Tracxn: “List of 7 Acquisitions by OpenAI (Jul 2025)”

- Wikipedia: “OpenAI”

- TechCrunch: “OpenAI acquires product testing startup Statsig”

- CNBC: “OpenAI tops 3 million paying business users”

- CNBC: “The man behind OpenAI’s global expansion”

- CNBC: “OpenAI’s GPT-5 is gaining where it matters most: Enterprise”

- OpenAI: “OpenAI acquires Rockset”

- Anthropic: “Anthropic raises Series E at $61.5B post-money valuation”

- TechCrunch: “Anthropic bundles Claude Code into enterprise plans”

- Anthropic: “Claude for Enterprise”

- Wikipedia: “Anthropic”

- Databricks: “Databricks and Anthropic Sign Landmark Deal”

- Anthropic: “Claude Code and new admin controls for business plans”

- Anthropic: “Offering expanded Claude access across all three branches of government”

- Salesforce: “Salesforce and Google Bring Gemini to Agentforce”

- VentureBeat: “Mistral AI just made enterprise AI features free”

- Capgemini: “Capgemini to acquire WNS”

- Accenture: “Accenture Expands Generative AI-Powered Cybersecurity Services”

- Brand Finance: “Global IT Services rebound: Top 25 brands hit $163 billion in 2025”

- EPAM: “EPAM Advances Strategic Collaboration Agreement with AWS Focusing on Generative AI”

- PRNewswire: “Globant Reimagines Traditional IT Services with AI Pods”

- EPAM: “What Is Holding Up AI Adoption for Businesses?”

- Globant: “Globant has announced the business trends for 2025”

- National University: “59 AI Job Statistics: Future of U.S. Jobs”

- McKinsey: “AI in the workplace: A report for 2025”

- AiMultiple: “Top 18 Predictions from Experts on AI Job Loss”

- FinalRound AI: “AI Job Displacement 2025: Which Jobs Are At Risk?”

- World Economic Forum: “Is AI closing the door on entry-level job opportunities?”

- World Economic Forum: “Why AI is replacing some jobs faster than others”