Executive Summary

As enterprises accelerate their AI transformation journeys, one critical question dominates boardroom discussions: Should we build, buy, or pursue a hybrid approach for our AI capabilities? This question has profound implications for competitive advantage, data sovereignty, operational efficiency, and long-term strategic positioning.

This comprehensive framework explores the key considerations that enterprise executives must evaluate when making AI investment decisions, drawing from current market data, real-world success stories, and strategic frameworks that balance innovation with pragmatism.

A) The Rising Tide: How Enterprises Are Shoring Up AI in Their Ecosystems

The enterprise AI landscape has transformed dramatically over the past 18 months, moving from experimental pilots to production-scale deployments. The statistics paint a compelling picture of this acceleration:

Current Adoption Landscape

Enterprise AI adoption has surged to 78% in 2024, up from 55% in 2023, with 71% of organizations now regularly using generative AI in business operations. This represents more than incremental growth—it signals a fundamental shift in how businesses view AI: from experimental technology to core business infrastructure.

Twenty-three percent of enterprises are now scaling agentic AI systems within their organizations, while an additional 39% have begun experimenting with AI agents. These systems, capable of acting autonomously and executing multi-step workflows, represent the next evolution beyond simple automation.

Investment Momentum

The financial commitment to AI is equally striking:

- U.S. private AI investment reached $109.1 billion in 2024, nearly 12 times higher than China’s investment

- The LLM market is projected to explode from $1.59 billion in 2023 to $259.8 billion by 2030, reflecting a 79.8% compound annual growth rate

- Companies that moved early into GenAI adoption report $3.70 in value for every dollar invested, with top performers achieving $10.30 returns per dollar

The Maturity Divide

However, adoption does not equal mastery. While nearly three-quarters of organizations reported their most advanced AI initiatives met or exceeded ROI expectations in 2024, roughly 97% of enterprises still struggled to demonstrate business value from early generative AI efforts.

This disconnect reveals a critical insight: successful AI adoption requires more than technology deployment—it demands organizational transformation.

Companies with a formal AI strategy report 80% success in AI adoption, compared to only 37% for those without a strategy. The message is clear: strategic planning and organizational alignment are as important as the technology itself.

B) Leading by Example: AI Spend by Non-Technology Industry Leaders

While technology companies dominate AI headlines, some of the most instructive examples come from traditional enterprises that have embraced AI-first strategies across their operations.

Retail Sector Leadership

Walmart has emerged as a non-tech AI leader, demonstrating how traditional retail can leverage AI for competitive advantage:

- Walmart reduced emergency alerts by 30% and decreased maintenance spend in refrigeration by 19% across Walmart US using digital twin technology powered by spatial AI

- Walmart’s e-commerce sales grew by nearly 80% during 2020, driven partly by AI-powered digital investments

- The company has deployed AI agents across payroll, merchandising, and product discovery, consolidating powerful time-saving tools for both associates and customers

Target has also made significant AI investments:

- Target deployed more than 10,000 new AI licenses across its teams in a single quarter

- The company leverages AI for demand forecasting, allowing teams to build updated forecasts more accurately while spending less time creating them

- Target partnered with PerfectCorp to implement AR-powered virtual try-on capabilities using AI-driven face mapping technology

Healthcare Sector Transformation

The healthcare industry represents one of the most aggressive AI adopters among non-tech sectors:

- Healthcare AI spending reached $1.4 billion in 2025, nearly tripling 2024’s investment, with implementation occurring at more than twice the rate of the broader U.S. economy

- Over one in five (22%) healthcare organizations have deployed domain-specific AI tools via paid commercial licenses in 2025—a 7x year-over-year increase and 10x increase from 2023

- Healthcare sector budgets allocated to AI and machine learning are projected to reach 10.5% in 2025, compared to 5.5% in 2022

Provider organizations, particularly hospitals and health systems, dominate spending at 75% of the total investment, focusing on workflow improvements, administrative automation, and diagnostic accuracy enhancement

Manufacturing and Industrial Applications

Traditional industries are leveraging AI for operational excellence:

- Companies like JPMorgan Chase, Caterpillar, and Walmart are using AI to improve operations rather than building infrastructure

- Manufacturing adoption reached 77% in 2024, up from 70% in 2023, with AI-driven predictive maintenance reducing downtime by 40%

Spending Patterns

37% of enterprises now spend over $250,000 annually on LLMs, with 73% spending over $50,000 yearly, and model API spending more than doubling to $8.4 billion in 2025.

These investments reflect a strategic shift: AI is no longer a line item in the innovation budget—it’s becoming core infrastructure spending.

C) The Boardroom Decision: How Executives Decide on AI Spend

Executive AI decision-making has evolved from “should we invest in AI?” to “how do we invest strategically in AI?” The most successful approaches share several common characteristics.

Strategic Alignment and Executive Sponsorship

Chief AI Officer roles are now present in 61% of enterprises, reflecting the elevation of AI to C-suite priority. This executive-level accountability ensures AI initiatives align with broader business strategy rather than existing as isolated technology projects.

AI high performers are more than three times more likely than others to say their organization intends to use AI to bring about transformative change to their businesses. They’re not seeking incremental improvements—they’re pursuing fundamental business model transformation.

ROI-Driven Investment Decisions

The pressure for measurable returns has intensified:

- 92% of executives expect to boost AI spending in the next three years, with 55% expecting investments to increase by at least 10% from current levels

- However, business leaders face increasing pressure to generate ROI from their GenAI deployments as companies move beyond the initial thrill

- Advanced organizations report ROI exceeding 30%, while over 80% still struggle to see tangible enterprise-level impact

Bold Executive Decisions That Paid Off

Several Non-Tech Companies Making Bold AI Investments

1. Woodside Energy’s Knowledge Democratization:

Woodside Energy worked with IBM Watson to make 30 years of expert knowledge from oil platform operations accessible to all employees, analyzing and classifying 38,000 written documents while maintaining proprietary control of the underlying data. This strategic decision enabled rapid knowledge access across the organization while protecting competitive data assets.

2. Global Tire Manufacturer’s Demand Prediction:

A global tire manufacturer developed an AI platform predicting demand at individual stores for specific tire models based on anticipated wear, using more than 1.6 billion public and private data points to increase sales and reduce dealer inventory levels. The company maintained control of this gold-mine capability while engaging vendors in supportive roles.

3. Metals Producer’s Data Strategy:

A large metals producer recognized that competitors and suppliers could pool data for competitive advantage and proactively began acquiring data on prices, suppliers, and materials from multiple sources, accelerating both AI and R&D efforts while opening new business opportunities.

Decision-Making Frameworks

Successful executives evaluate AI investments through multiple lenses:

- Strategic Value: Does this AI capability create or protect competitive differentiation?

- Data Positioning: Do we have unique data access that creates an advantage?

- Time to Value: Can we achieve meaningful ROI within acceptable timeframes?

- Risk Management: What are the implications for data security, regulatory compliance, and vendor dependency?

- Organizational Readiness: Do we have the talent, culture, and infrastructure to execute effectively?

Executives are no longer dismissing investments as “just another data project”—they recognize that great AI relies on great data, and are finally doubling down on getting data right.

D) The Central Challenge: Key Considerations for Build vs Buy Decisions

The build-or-buy question in AI is rarely binary. Most successful approaches involve a nuanced combination of building proprietary capabilities, buying vendor solutions, and partnering strategically.

Why AI Is Different from Traditional Technology

In this blog we will reference and acknowledge BCG Framework. As the BCG framework highlights, AI vendors have attracted most of the AI talent, compelling companies to work with them, while AI vendors rely heavily on data that only their customers can provide, creating an interdependent relationship.

This creates unique dynamics:

1. The Talent Scarcity Factor

Few seasoned AI professionals currently work in the field, and still fewer understand business processes or have experience interacting with business executives. This supply-and-demand imbalance makes pure “build” approaches challenging for most enterprises.

2. Data-Model Interdependence

AI algorithms need to be trained on data, and vendors normally cannot sell plug-and-play applications—they need to work closely with clients on AI training both during and after run-time deployment. This requirement for ongoing collaboration fundamentally changes the vendor relationship.

3. The Risk of Vendor Dependency

If companies don’t build internal capabilities, they risk becoming dependent on vendors, and if they are careless, they may share valuable intelligence that weakens their competitive position.

Critical Build vs Buy Considerations

Executives should evaluate several key factors:

Strategic Importance

- How critical is this capability to your competitive differentiation?

- Does it touch core business processes that define your value proposition?

- Could vendor dependency in this area constrain future strategic options?

Data Differentiation

- Do you have access to unique, high-quality data?

- Is your data advantage sustainable over time?

- Can vendors aggregate data across multiple clients to create superior models?

Speed and Scale Requirements

- How quickly do you need this capability in production?

- What scale of deployment is required?

- Do you have the infrastructure to support rapid scaling?

Cost Structure Analysis

- What are the total costs of building vs buying over a 3–5 year horizon?

- How do licensing costs scale with usage?

- What hidden costs exist in integration, maintenance, and talent acquisition?

Risk and Compliance

- What data governance requirements apply?

- How do different approaches affect regulatory compliance?

- What are the cybersecurity implications of each option?

Organizational Capability

- Do you have the technical talent required?

- Is your data infrastructure production-ready?

- Can your organization manage the change management required?

Common Pitfalls to Avoid

The top failure factors are: technology-first approach without organizational change planning (45% of failures), insufficient change management and user adoption support (38%), unrealistic timeline expectations (32%), lack of executive alignment (29%), and poor data quality and infrastructure foundation (26%).

E) The Strategic Framework: Build vs Buy or Build AND Buy

The most sophisticated approach to AI sourcing involves a portfolio strategy that balances building proprietary capabilities with strategic vendor partnerships. The BCG framework provides an excellent foundation for this decision-making.

The BCG Four-Quadrant Framework

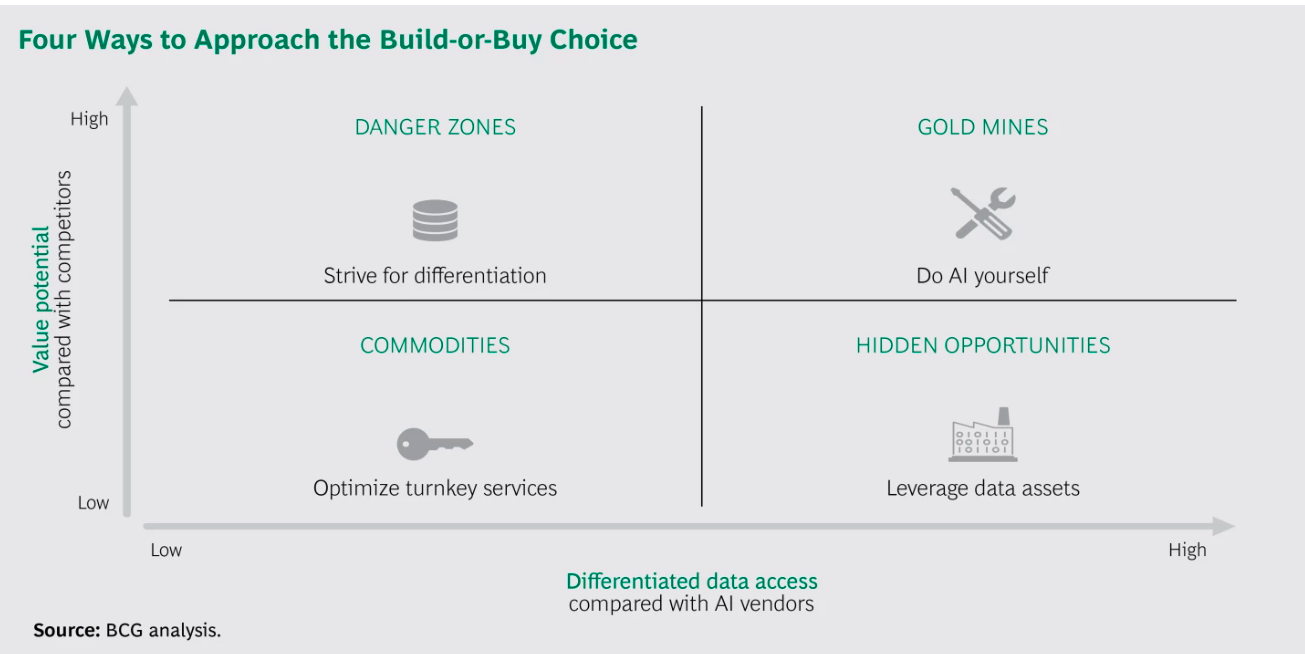

The BCG framework categorizes AI decisions based on two dimensions (as shown in the Figure 1):

FIGURE 1: (Build or Buy Framework): Credit for this photo: BCG Article

Vertical Axis: Value potential compared with competitors (Low to High) Horizontal Axis: Differentiated data access compared with AI vendors (Low to High)

This creates four distinct quadrants, each requiring different strategies:

Quadrant 1: COMMODITIES (Low Value + Low Data Differentiation)

Strategy: Optimize Turnkey Services

This area is the closest to off-the-shelf solutions and a great entry portal into AI, where companies can share data with vendors without fear of losing competitive differentiation.

Examples:

- HR management and recruitment screening

- Finance and accounting automation

- IT infrastructure management

- Facilities maintenance

Approach:

- Business process outsourcers are revising their business models to offer AI-technology-enabled solutions

- Vendors like HireVue screen job candidates using AI analysis of characteristics like word choice and facial expressions, with a database of more than 20 million video interviews

- Focus on cost reduction and performance improvement

- Conduct proof-of-concept work internally to establish baselines before negotiating with vendors

NStarX Perspective: Leverage established vendor solutions for non-differentiating processes, freeing resources for strategic AI initiatives.

Quadrant 2: HIDDEN OPPORTUNITIES (Low Value + High Data Differentiation)

Strategy: Leverage Data Assets

Companies have access to data sources in areas that are not critical to competitive advantage, providing an opportunity to tap into vendor technological expertise and generate quick wins.

Examples:

- Historical document repositories

- Legacy knowledge bases

- Non-competitive operational data

- Industry-standard processes with company-specific data

Approach:

- Woodside Energy worked with IBM Watson using natural language processing to analyze 38,000 documents while maintaining proprietary control of underlying data

- Partner with data-constrained AI vendors

- Potentially sell application services pretrained on your data to related industries

- Create data-sharing pools with other companies and vendors

NStarX Perspective: These represent low-risk experimentation opportunities that build organizational AI capability while delivering tangible value.

Quadrant 3: DANGER ZONES (High Value + Low Data Differentiation)

Strategy: Strive for Differentiation

Vendors have better access to data than the companies themselves in strategically critical areas, requiring careful management to limit vendor dependency and minimize loss of competitive differentiation.

Examples:

- Healthcare diagnostic imaging (vendors can aggregate patient data across providers)

- Supply chain optimization (vendors pool data across industry)

- Customer behavior prediction (vendors aggregate cross-industry patterns)

- Industry-standard analytics with strategic importance

Approach:

- Companies should develop data-acquisition strategies, acquire differentiated data, create novel data mashups from multiple sources, or even acquire suppliers of data in areas critical to competitive advantage

- A large metals producer began acquiring data on prices, suppliers, and materials from various sources to accelerate AI and R&D efforts and potentially open new business opportunities

- Work strategically with vendors while building proprietary data advantages

- Consider data partnerships or acquisitions

NStarX Perspective: Danger zones require active management to avoid competitive disadvantage. The goal is to migrate these capabilities toward gold-mine status through strategic data acquisition and capability building.

Quadrant 4: GOLD MINES (High Value + High Data Differentiation)

Strategy: Do AI Yourself (with Strategic Support)

Companies need to do AI themselves when they have a gold mine, bringing in vendors and experts only in supportive roles.

Examples:

- Core product innovation

- Proprietary customer experience systems

- Unique operational processes

- Strategic decision-making systems

Approach:

- A global tire manufacturer developed an AI platform to predict demand at individual stores using more than 1.6 billion public and private data points, helping increase sales and reduce inventory

- Build strong in-house talent teams

- Manage complex “frenemy” relationships with suppliers

- Maintain sharp focus on what to manage in-house vs. source externally

- Consider cooperative platforms with other companies

NStarX Perspective: Gold mines are where you build proprietary competitive advantages. Investment here should be bold, strategic, and protected. This is where Service-as-Software models can create sustainable differentiation.

The NStarX Balanced Framework: Build AND Buy

Core Principle: The most successful enterprises don’t choose build OR buy—they orchestrate a portfolio approach that optimizes each quadrant differently.

Strategic Recommendations:

- Build Your Gold Mines: Invest heavily in proprietary capabilities where you have data differentiation and high strategic value.

- Buy Your Commodities: Leverage vendor solutions for non-differentiating processes to free resources for strategic initiatives.

- Partner for Hidden Opportunities: Use collaborative approaches to extract value from non-critical data assets while building organizational capability.

- Transform Your Danger Zones: Actively work to acquire data advantages and build capabilities that shift danger zones toward gold mine status.

- Maintain Strategic Flexibility: Boundaries will continually shift over time—areas of competitive differentiation will evolve, and data pools that are distinctive today may lose value as data proliferates.

F) Understanding the Landscape: Open Source vs Closed Systems

As enterprises implement their build-and-buy strategies, a critical technical decision emerges: should they leverage open-source AI systems, closed proprietary systems, or a hybrid approach?

The Open Source Advantage

Open-source AI models have evolved from experimental alternatives to enterprise-grade options:

Key Benefits:

- Transparency and Control: Open-source AI models allow organizations to peer into architecture, training data, and tweak the model, providing full transparency. This visibility enables organizations to understand model behavior, address bias, and verify accuracy in their specific context.

- Customization and Fine-Tuning: Open AI makes sense for companies looking to benefit from the default behaviors of AI applications, enabling modification and experimentation especially in vertical domains.

- Cost Efficiency: Open-source models eliminate or reduce the need for expensive API calls and allow organizations to optimize costs based on their specific usage patterns.

- Data Sovereignty: Organizations retain full control over data used for training and inference, critical for regulated industries and competitive differentiation.

- Community Innovation: Meta’s openly available models have been downloaded more than 400 million times, at a rate 10 times higher than last year, with more than 65,000 model derivatives in the market.

Leading Open-Source Models:

- Meta’s LLaMA 3 has been downloaded over 1.2 billion times, with models ranging from 8B to 70B parameters

- Mistral and Mixtral models for specialized applications

- Alibaba’s Qwen 3 supporting up to 128K token context windows

- Community-driven models like BLOOM and Falcon

The Closed System Advantage

Proprietary models from vendors like OpenAI, Anthropic, and Google continue to offer compelling benefits:

Key Benefits:

- Performance Leadership: Proprietary LLMs like GPT-4 and Claude still top benchmarks for high-stakes tasks.

- Enterprise-Grade Support: Closed AI vendors often provide infrastructure and support services to speed adoption by enterprise apps, along with SLAs and security patches.

- Rapid Innovation: Closed models tend to provide faster development cycles that improve security and performance.

- Simplified Deployment: Closed platforms offer turnkey experiences with polished tools that work right away, allowing teams to start without deep AI expertise.

- Regulatory Compliance Support: Vendors invest heavily in compliance frameworks for regulated industries, sharing the burden of regulatory adherence.

Leading Closed Models:

- Anthropic’s Claude 4.1 ranks very high (74.5%) on SWE-bench Verified metrics and generates up to 32,000 output tokens

- OpenAI’s GPT-4.5 for advanced natural language understanding

- Google’s Gemini 2.0 for reasoning and multimodal capabilities

The Hidden Tradeoffs

Open Source Challenges: Open code invites security experts to find and fix flaws but also gives attackers the same blueprints.

- Requires more internal expertise and infrastructure

- May have slower performance for general-purpose tasks

- Demands more investment in compliance verification

- Needs ongoing maintenance and security updates

Closed System Challenges: Closed AI ecosystems offer turnkey experience but come with vendor lock-in—your AI future is hitched to someone else’s roadmap and pricing model.

- Limited transparency makes it difficult to explain model behavior

- 45% of business leaders cite data accuracy or bias as their biggest obstacle to adopting AI, often stemming from closed “black-box” systems

- Dependency on vendor roadmaps and pricing

- Less customization for specific use cases

Decision Framework: When to Choose What

Choose Open Source When:

- You need complete control over proprietary data and models

- Customization and fine-tuning are critical for your use case

- You have technical expertise to manage deployment

- Cost optimization and scaling economics are important

- Regulatory explainability and auditability are required

- You’re in regulated industries requiring complete transparency

Choose Closed Systems When:

- Time to market is critical

- You need enterprise-grade support and SLAs

- Your team lacks deep AI/ML expertise

- You require the highest performance for general tasks

- Vendor-managed compliance is valuable

- You’re in the experimental or pilot phase

Choose Hybrid When:

- Different use cases have different requirements

- You want to avoid single-vendor dependency

- You’re balancing innovation with risk management

- You need both rapid deployment and long-term customization

G) The Hyperscaler Ecosystem: Navigating Open Source in a Closed World

As OpenAI, Anthropic (Claude), and hyperscalers like Google, Microsoft, and AWS make significant strides, enterprises face a complex landscape where open source and closed systems coexist and interoperate.

The Changing Competitive Landscape

The competitive landscape has shifted dramatically in 2025, with Anthropic capturing 32% of enterprise market share compared to OpenAI’s 25% and Google’s 20%, while Google’s models show 69% developer usage.

This indicates a critical trend: most enterprises deploy multiple models simultaneously, with 37% of enterprises using 5+ models in production environments.

Why Open Source Remains Critical

Despite the power of closed systems, open source continues to gain enterprise traction:

Oracle’s EVP Greg Pavlik states: “I think open models will ultimately win out,” citing the ability to modify models and experiment, especially in vertical domains, combined with favorable costs.

SAP announced comprehensive open-source LLM support through its Joule AI copilot, while ServiceNow enabled both open and closed LLM integration for workflow automation.

The Hybrid Enterprise Architecture

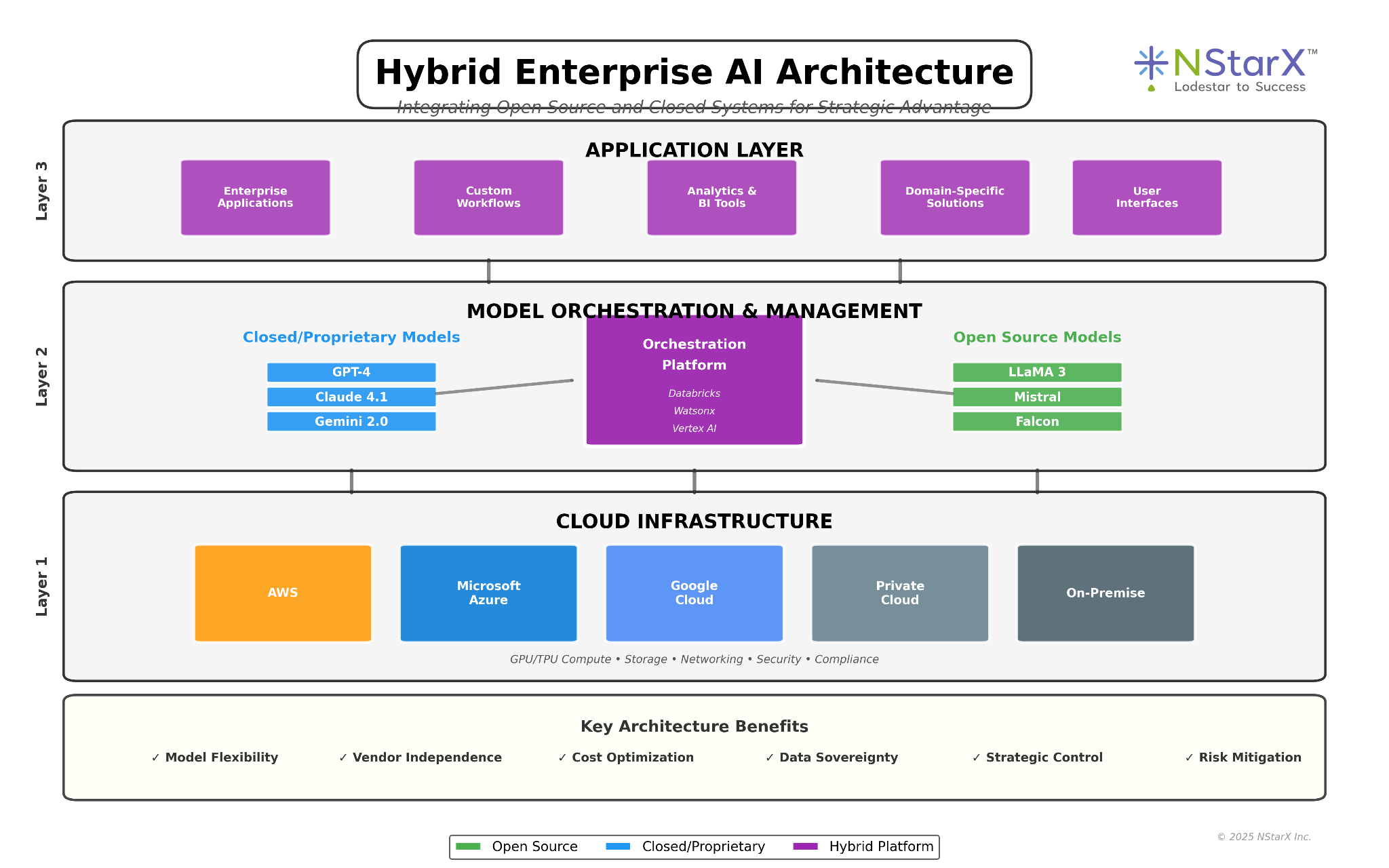

The most sophisticated enterprises are building what might be called “polyglot AI architectures”. See this in the Figure 2 below with descriptions of the architecture:

Figure 2: Enterprise Hybrid Architecture for leveraging Open/Closed Systems in an Enterprise

Layer 1: Cloud Infrastructure Cloud platforms are critical infrastructure partners for the genAI era, both through direct model serving and by enabling enterprises to self-host open-source models.

Layer 2: Model Orchestration Sophisticated organizations integrate closed models for generalized capabilities while layering open-source components for sensitive, high-risk, or domain-specific applications.

Layer 3: Application Layer Platforms like Databricks, IBM Watsonx, Hugging Face, and Vertex AI support hybrid AI architectures, allowing enterprises to run proprietary models alongside open ones with consistent governance policies.

Real-World Hybrid Examples

Example 1: Financial Services Dual-Track A chatbot for customer support may rely on a commercial LLM for rapid interaction and multilingual coverage, but when the customer initiates a complaint involving contract terms, the interaction switches to an internal, fine-tuned model operating within secure, auditable systems.

Example 2: Healthcare RAG Architecture Organizations use open-source retrieval systems like FAISS or Weaviate to store and retrieve knowledge from internal documents for full data governance, while leveraging closed-source AI models like Microsoft Copilot for enterprise-grade integration with prebuilt RAG architectures.

Example 3: Retail Hybrid Intelligence A global retailer uses open models like LLaMA 3 and Mistral running inside secure environments for supply and shipping optimization with full audit trails, while using closed-API partners for customer-facing chatbots that require seamless performance and uptime guarantees.

Example 4: Manufacturing Excellence Databricks, built around Apache Spark (100% open source), provides enterprise-grade features like security, compliance, and managed infrastructure not available in the open-source version, while actively contributing back to the ecosystem.

Example 5: Volkswagen’s Custom Approach Volkswagen building automotive AI applications didn’t care about standard benchmarks but whether a given model could meet its specific needs, working with vendors to assemble custom automotive industry-specific benchmarks for model evaluation.

Strategic Recommendations for Hybrid Approaches

1. Multi-Model Strategy Based on customer interviews, 94% of organizations use 2 or more LLM providers, with this hybrid strategy allowing companies to optimize for specific use cases while reducing dependency on single providers.

2. Infrastructure Portability Build on an open-source foundation that allows you to run any model, on any accelerator, on any cloud, without compromising current or future IT decisions.

3. Governance Framework Apply consistent governance policies across both open and closed environments through unified platforms.

4. Cost Optimization Open-source developments, efficiency gains, and broader competition are driving down model costs, with OpenAI’s token cost seeing a 10x decrease since 2023.

5. Vendor Management Maintain relationships with multiple vendors while building internal capabilities that provide negotiating leverage and prevent lock-in.

The OPEA Initiative: Open Standards for Enterprise AI

The Open Platform for Enterprise AI (OPEA) initiative brings together industry leaders to drive innovation in cloud and AI-native solutions, providing enterprise-ready blueprints and accelerators to achieve AI benefits faster and more safely.

This collaborative approach represents the future: neither purely open nor purely closed, but interoperable systems with consistent standards.

H) The Future Landscape: How Build and Buy Will Evolve

As we look toward the next 3-5 years, several trends will reshape the build-vs-buy landscape in enterprise AI.

Trend 1: The Rise of AI Agents and Autonomous Systems

Agentic AI systems capable of acting in the real world, planning and executing multiple steps in workflows, are being scaled by 23% of enterprises, with an additional 39% experimenting.

Implications:

- Build decisions will increasingly focus on agent orchestration and governance rather than model development

- Buy decisions will shift toward agent platforms and integration frameworks

- The boundary between building and buying will blur as enterprises assemble agent ecosystems from multiple sources

Trend 2: Model Commoditization and Differentiation Through Data

Areas of competitive differentiation will evolve, and data pools that are distinctive today may lose value as data proliferates.

Implications:

- Pure model performance will become less differentiating over time

- Competitive advantage will shift to proprietary data, workflow integration, and domain expertise

- “Build” will increasingly mean building data advantages, not just model capabilities

Trend 3: Open-Core Business Models

Open-core models involve releasing foundational AI algorithms as open source while offering proprietary tools or platforms that enhance these models for commercial use.

Implications:

- The line between open and closed will continue blurring

- Enterprises will build on open foundations while adding proprietary enhancements

- Vendors will offer “open core” with commercial extensions

Trend 4: Industry-Specific AI Platforms

85% of all generative AI spend in healthcare flows to startups rather than incumbents, with AI-native challengers gaining rapid market share by designing products natively around AI capabilities.

Implications:

- Vertical-specific AI platforms will proliferate

- Build decisions will focus on customizing vertical platforms rather than building from scratch

- Buy decisions will favor specialized vendors over horizontal platforms

Trend 5: Regulatory Pressure for Transparency

Regulatory pressure raises stakes in sectors like finance, healthcare, and government, with the NIST AI Risk Management Framework encouraging supplier management practices including SLAs and third-party attestation.

Implications:

- Demand for explainable AI will favor open source in regulated industries

- Closed vendors will need to provide more transparency

- Hybrid approaches with auditable open-source components will become standard

Trend 6: Cost Economics Reshaping Decisions

Cost dynamics are evolving quickly with open-source developments and efficiency gains driving down model costs.

Implications:

- The pure cost advantage of open source will narrow

- Build decisions will need stronger strategic justification beyond cost

- Vendor pricing pressure will make buy options increasingly attractive

Trend 7: Interoperability Standards

Anthropic’s Model Context Protocol (MCP) and similar initiatives enable agents to work across different ecosystems, creating a more fluid experience where users gain choice while the total ecosystem grows larger.

Implications:

- Lock-in concerns will diminish as standards emerge

- Build decisions can leverage multiple vendor APIs interchangeably

- Buy decisions carry less risk of strategic constraint

Trend 8: Edge AI and Distributed Deployment

73% of enterprises are moving toward edge AI for real-time processing and privacy.

Implications:

- Build decisions will increasingly involve edge deployment architecture

- Buy decisions must consider edge compatibility and offline operation

- Hybrid approaches combining cloud and edge will become standard

The Evolving Decision Framework

Short Term (2025-2026):

- Experimentation with multiple models and vendors

- Building data foundations and governance frameworks

- Establishing centers of excellence and capability hubs

- Pilot deployments balancing build and buy

Medium Term (2026-2028):

- Consolidation around preferred vendor ecosystems

- Strategic build investments in core differentiating capabilities

- Industry platforms emerging as buy options

- Hybrid architectures maturing with clear patterns

Long Term (2028-2030):

- AI-native operating models standard across industries

- Build focuses on orchestration, data strategy, and domain expertise

- Buy focuses on infrastructure, base models, and specialized tools

- Seamless interoperability enabling fluid build-buy combinations

I) Conclusion: Strategic Imperatives for Enterprise AI Success

The build-or-buy question in enterprise AI demands nuanced, strategic thinking that goes beyond simple cost calculations or vendor evaluations. As we’ve explored throughout this framework, the most successful enterprises are those that:

1. Embrace Portfolio Thinking

Stop thinking build OR buy. Start thinking build AND buy.

- Build your gold mines where you have data differentiation and high strategic value

- Buy your commodities to free resources for strategic initiatives

- Partner for hidden opportunities to build capability while extracting value

- Transform your danger zones through strategic data acquisition

2. Balance Open and Closed Systems Strategically

94% of organizations use 2 or more LLM providers, with hybrid strategies allowing optimization for specific use cases while reducing single-vendor dependency.

The future isn’t open source versus closed source—it’s intelligent orchestration of both based on specific requirements:

- Open for transparency, customization, and cost optimization

- Closed for performance, support, and rapid deployment

- Hybrid for risk management and strategic flexibility

3. Prioritize Organizational Transformation

Boston Consulting Group found that successful AI transformations allocate 70% of their efforts to upskilling people, updating processes, and evolving culture.

- Companies with formal AI strategies report 80% success versus 37% without strategies

- Technology-first approaches without organizational change planning account for 45% of AI failures

- Executive alignment, change management, and realistic timelines are non-negotiable

4. Build Data Advantages Relentlessly

In an era where models are increasingly commoditized, data becomes the primary source of competitive differentiation:

- Develop data-acquisition strategies and create differentiated data assets

- Create novel data mashups or acquire suppliers of critical data

- Treat data sovereignty and governance as strategic imperatives

5. Maintain Strategic Flexibility

Boundaries will continually shift—acting systematically and decisively secures the future.

- Gold mines today may become commodities tomorrow

- Build requirements today may have strong vendor alternatives next year

- Avoid architectural lock-in and rigid long-term decisions

6. Invest Boldly in Core Capabilities

High performers are three times more likely to pursue transformative, not incremental, AI change.

- Top performers achieve $10.30 returns per GenAI dollar invested

- Advanced organizations report ROI exceeding 30%

- Bold ambitions plus committed resources create transformational outcomes

7. Build Vendor Ecosystems, Not Vendor Dependencies

The most successful enterprises are strategic in choosing between open and closed AI systems.

- Cultivate relationships with multiple vendors

- Build internal expertise to increase negotiation leverage

- Create architectures enabling vendor switching

- Participate actively in open-source ecosystems and standards bodies

The NStarX Way Forward

At NStarX, we believe the future of enterprise AI lies in Service-as-Software models built on a foundation of strategic clarity:

Service-as-Software Principles:

- Unified Intelligence: Leverage both open and closed systems through a unified data lake and neural platform (DLNP)

- Federated Learning: Build AI capabilities that learn across distributed data without centralizing sensitive information

- Domain Expertise: Combine AI technology with deep industry knowledge in healthcare, media, financial services, and manufacturing

- Pragmatic Innovation: Balance cutting-edge technology with proven enterprise-grade reliability

- Strategic Partnership: Act as both technology provider and strategic advisor, helping clients navigate build-buy decisions

Final Thought: It’s Not About the Technology

The most important insight from our analysis is this: successful AI adoption is fundamentally about business transformation, not technology deployment.

Organizations achieving measurable ROI don’t just implement AI tools—they systematically rewire how work gets done.

The build-vs-buy decision is actually a series of interconnected choices about:

- Where you want to compete and differentiate

- What capabilities you need to own versus access

- How you balance risk and reward

- What kind of organization you’re building for the future

Make these decisions strategically, with clear-eyed assessment of your competitive position, data advantages, organizational capabilities, and market dynamics. The companies that will thrive in the AI era are those that act decisively while maintaining the flexibility to adapt as the landscape evolves.

The future belongs not to those who build everything or buy everything, but to those who build the right things and buy the right things—and have the wisdom to know the difference.

J) References

Primary Research and Data Sources

- McKinsey & Company – “The state of AI in 2025: Agents, innovation, and transformation” – https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

- Boston Consulting Group (BCG) – “The Build-or-Buy Dilemma in AI” (January 2018) – Internal document provided

- Netguru – “AI Adoption Statistics in 2025” – https://www.netguru.com/blog/ai-adoption-statistics

- Anthropic – “Anthropic Economic Index Report: Uneven Geographic and Enterprise AI Adoption” (September 2025) – https://www.anthropic.com/research/anthropic-economic-index-september-2025-report

- Fullview – “200+ AI Statistics & Trends for 2025: The Ultimate Roundup” – https://www.fullview.io/blog/ai-statistics

- ISG – “State of Enterprise AI Adoption Report 2025” – https://isg-one.com/state-of-enterprise-ai-adoption-report-2025

- Wharton – “2025 AI Adoption Report: Gen AI Fast-Tracks Into the Enterprise” – https://knowledge.wharton.upenn.edu/special-report/2025-ai-adoption-report/

- Writer – “Key findings from our 2025 enterprise AI adoption report” – https://writer.com/blog/enterprise-ai-adoption-survey/

- Second Talent – “AI Adoption in Enterprise Statistics & Trends 2025” – https://www.secondtalent.com/resources/ai-adoption-in-enterprise-statistics/

- TypeDef – “13 LLM Adoption Statistics: Critical Data Points for Enterprise AI Implementation in 2025” – https://www.typedef.ai/resources/llm-adoption-statistics/

Industry-Specific AI Adoption

- Morningstar – “Why the AI Spending Spree Could Spell Trouble for Investors” – https://www.morningstar.com/markets/why-ai-spending-spree-could-spell-trouble-investors

- Emerj – “Machine Learning in Big Box Retail – Walmart, Target, and Costco” – https://emerj.com/ai-sector-overviews/machine-learning-big-box-retail/

- Emerj – “AI at Walmart – Comparison to Amazon, and Two Unique Use-Cases” – https://emerj.com/ai-at-walmart/

- Walmart – “2025 AI Trends Outlook” – https://corporate.walmart.com/news/2024/11/20/2025-ai-trends-outlook

- The Information – “The Generative AI Spending of 50 Companies, From Coke to Walmart” – https://www.theinformation.com/articles/the-generative-ai-shopping-carts-of-50-companies-from-coke-to-walmart

- PYMNTS – “Healthcare Sector Will Devote 10.5% of Spending to AI” – https://www.pymnts.com/artificial-intelligence-2/2023/healthcare-sector-will-devote-10-5-of-spending-to-ai/

- eMarketer – “AI spending in healthcare outpaces the overall US economy” – https://www.emarketer.com/content/ai-spending-healthcare-outpaces-overall-us-economy-

- Menlo Ventures – “2025: The State of AI in Healthcare” – https://menlovc.com/perspective/2025-the-state-of-ai-in-healthcare/

- CNBC – “Walmart’s latest AI innovations represent a shift for big retail” – https://www.cnbc.com/2025/08/30/walmart-stores-ai-innovation-retail-shopping-shift.html

- CIO Dive – “Walmart, Target tout AI plans” – https://www.ciodive.com/news/Walmart-Target-AI-investments-initatives-use-cases/758326/

Open Source vs Closed Systems

- Index – “Open-Source vs Closed AI: Trust, Security & Performance” – https://www.index.dev/blog/open-source-vs-closed-ai-guide

- TechTarget – “Attributes of Open vs. Closed AI Explained” – https://www.techtarget.com/searchenterpriseai/feature/Attributes-of-open-vs-closed-AI-explained

- DEV Community – “OpenAI’s GPT-OSS Models vs Claude 4.1: How Open-Weight and Closed-Source AI Are Redefining the Future” – https://dev.to/grenishrai/openais-gpt-oss-models-vs-claude-41-how-open-weight-and-closed-source-ai-are-redefining-the-3m3g

- Medium (Dubeysuman) – “Open Source vs. Closed Source AI Models: A 2025 Perspective” – https://medium.com/@dubeysuman222/open-source-vs-closed-source-ai-models-a-2025-perspective-52b8f4962bdf

- Adopt.ai – “Open vs. Closed: The AI Agent Ecosystem Battle” – https://www.adopt.ai/blog/open-vs-closed-the-ai-agent-ecosystem-battle

- Medium (Akanksha Sinha) – “The Open vs. Closed AI Frontier: Navigating Transparency, Power, and the Future of Innovation” – https://medium.com/@akankshasinha247/the-open-vs-closed-ai-frontier-navigating-transparency-power-and-the-future-of-innovation-4b96c68feb06

- Multimodal.dev – “Open-Source AI vs. Closed-Source AI: What’s the Difference?” – https://www.multimodal.dev/post/open-source-ai-vs-closed-source-ai

- VKTR – “Open-Source vs Closed-Source AI: Which Model Should Your Enterprise Trust?” – https://www.vktr.com/ai-platforms/open-source-vs-closed-source-ai-which-model-should-your-enterprise-trust/

- Medium (Dr Barak Or) – “Open vs. Closed LLMs in 2025: Strategic Tradeoffs for Enterprise AI” – https://medium.com/data-science-collective/open-vs-closed-llms-in-2025-strategic-tradeoffs-for-enterprise-ai-668af30bffa0

- Claude AI Hub – “Is Claude AI Open Source?” – https://claudeaihub.com/is-claude-ai-open-source/

Hybrid Approaches and Enterprise Implementation

- CB Insights – “Should enterprises adopt closed-source or open-source AI models?” – https://www.cbinsights.com/research/enterprise-adoption-closed-source-open-source-ai-models/

- Medium (Devansh) – “Understanding the Business of Open Source Software and AI” – https://machine-learning-made-simple.medium.com/understanding-the-business-of-open-source-software-and-ai-0aa43a480450

- OPEA – “Open Platform For Enterprise AI” – https://opea.dev/

- VentureBeat – “The enterprise verdict on AI models: Why open source will win” – https://venturebeat.com/ai/the-enterprise-verdict-on-ai-models-why-open-source-will-win

- Prime Properties BLR – “Maximizing Enterprise AI Success: How to choose between Open, Closed and Hybrid AI Models” – https://primepropertiesblr.com/maximizing-enterprise-ai-success-how-to-choose-between-open-closed-and-hybrid-ai-models/

- Red Hat – “8 enterprise AI stories you don’t want to miss” – https://www.redhat.com/en/blog/8-enterprise-ai-stories-you-dont-want-miss

- Red Hat – “What you don’t see could cost you: Why open source matters in enterprise AI” – https://www.redhat.com/en/blog/why-open-source-matters-enterprise-ai

- Tech Brew – “Tech leaders talk pros and cons of open-source AI in business” – https://www.techbrew.com/stories/2025/06/10/tech-leaders-ibm-huggingface-open-source-ai

Executive Decision-Making and Transformation

- Harvard Business Review – “6 Ways AI Changed Business in 2024, According to Executives” – https://hbr.org/2025/01/6-ways-ai-changed-business-in-2024-according-to-executives

- McKinsey – “AI in the workplace: A report for 2025” – https://www.mckinsey.com/capabilities/tech-and-ai/our-insights/superagency-in-the-workplace-empowering-people-to-unlock-ais-full-potential-at-work

- Microsoft – “AI-powered success—with more than 1,000 stories of customer transformation and innovation” – https://blogs.microsoft.com/blog/2025/04/22/https-blogs-microsoft-com-blog-2024-11-12-how-real-world-businesses-are-transforming-with-ai/

- Deloitte – “State of Generative AI in the Enterprise 2024” – https://www.deloitte.com/us/en/what-we-do/capabilities/applied-artificial-intelligence/content/state-of-generative-ai-in-enterprise.html

- PWC – “2025 AI Business Predictions” – https://www.pwc.com/us/en/tech-effect/ai-analytics/ai-predictions.html

- AI Business – “AI in 2025: Driving Business Transformation and Growth” – https://aibusiness.com/agentic-ai/ai-in-2025-driving-business-transformation-and-growth

- Axis Intelligence – “AI Transformation Delivers $2.4M Annual Savings: How 73% of Enterprises Are Rewiring Operations in 2025” – https://axis-intelligence.com/ai-transformation-enterprise-2025-strategy/

- TRooTech – “Enterprise AI in Action—10 Real-World Use Cases 2025” – https://www.trootech.com/blog/ai-use-cases-in-real-world

- Warmly – “35+ Powerful AI Agents Statistics: Adoption & Insights [November 2025]” – https://www.warmly.ai/p/blog/ai-agents-statistics

Document prepared by NStarX Inc. Empowering AI-First Enterprise Transformation

For more information about NStarX’s Service-as-Software solutions and our unified Platform, contact us at info@nstarxinc.com

© 2025 NStarX Inc. All rights reserved.